Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

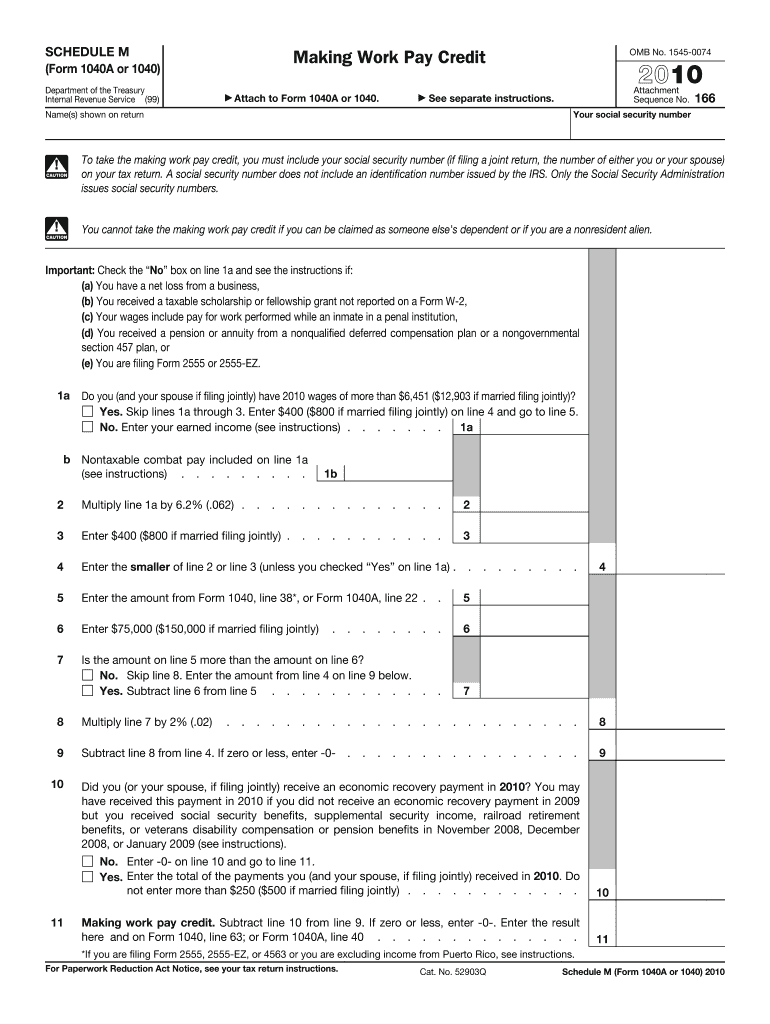

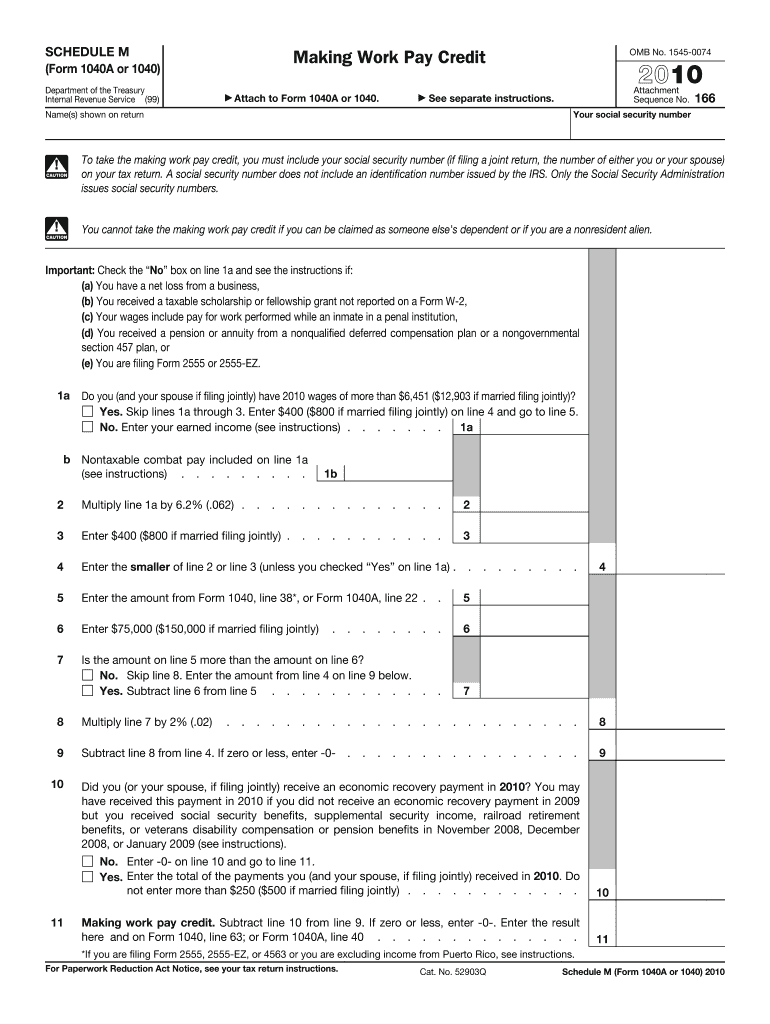

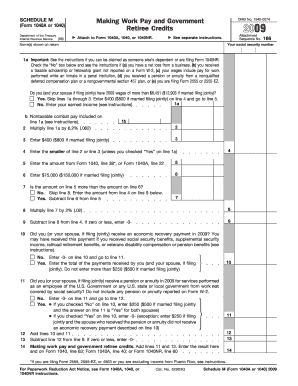

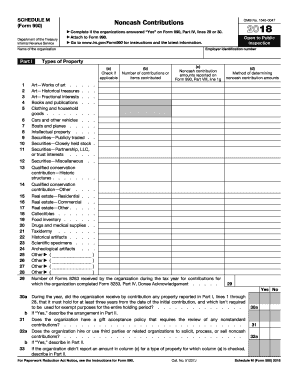

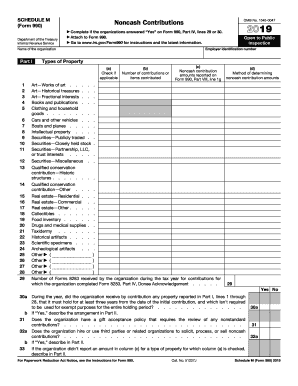

Form 1040A is a federal tax form used by individuals to file an annual income tax return with the Internal Revenue Service (IRS). It is an alternative to Form 1040 and is designed for taxpayers with simpler tax situations. It is shorter than Form 1040 and allows filers to claim fewer credits and deductions. The form is two pages long and requires filers to report their income, deductions, and credits.

What information must be reported on form 1040a?

Form 1040A includes the filer's income, deductions, and credits. Specifically, the form requires filers to report their adjusted gross income (AGI), taxable income, any applicable credits, and any taxes owed. It also includes information about the filer's filing status, dependents, and other income sources.

What is the penalty for the late filing of form 1040a?

If you fail to file your federal tax return by the due date, you may be subject to a failure-to-file penalty. The penalty is usually 5% of the unpaid taxes for each month or part of a month that a return is late. The maximum penalty is 25% of your unpaid taxes. If you do not pay your taxes by the due date, you will face a failure-to-pay penalty of 0.5% of your unpaid taxes per month or part of a month, up to a maximum of 25%.

Who is required to file form 1040a?

Form 1040A was discontinued as of tax year 2018. As of 2019, taxpayers must use either Form 1040 or Form 1040-SR (for seniors) to file their federal income tax returns. The specifics of who is required to file each form depends on their individual circumstances, income level, and filing status. It is recommended for individuals to consult the IRS guidelines or seek professional tax advice to determine which form they should use and whether they are required to file.

How to fill out form 1040a?

To fill out Form 1040A, follow these steps:

1. Gather all necessary documents like your W-2 forms and any additional income statements or documents related to deductions or credits.

2. Begin by providing your personal information on the top of the form, including your name, address, social security number, and filing status.

3. Enter your income on line 7, which includes wages, salaries, tips, and other taxable income. If you have more than one source of income, use Schedule 1 to report additional income.

4. Deduct any adjustments to income you may have on lines 23 through 35. Common deductions include student loan interest and contributions to retirement accounts.

5. Subtract your adjustments to income from your total income to arrive at your adjusted gross income (AGI) on line 37.

6. If you have taxable interest or dividends, report them on lines 8a and 8b, respectively.

7. Determine your standard deduction by referencing your filing status and enter it on line 40. If you have itemized deductions, use Schedule A to calculate them instead.

8. Subtract your standard deduction from your AGI to calculate your taxable income on line 41.

9. Calculate your total tax liability by referencing the tax table or using the tax computation worksheet provided in the Form 1040A instructions.

10. Enter any tax credits you qualify for on lines 42 through 47.

11. Calculate your total tax by subtracting your tax credits from your total tax liability on line 48.

12. If you had any federal income tax withheld from your paychecks, report that amount on line 49.

13. Determine if you owe additional taxes or if you are entitled to a refund by comparing your total tax amount on line 48 to your total tax withheld on line 49.

14. If you qualify for any additional refundable credits, such as the Earned Income Tax Credit, enter them on lines 66a and 66b.

15. If you owe additional taxes, enter the amount on line 78 and include payment with your return. If you are due a refund, enter the amount on line 76, and choose how you want to receive your refund - by mail or by direct deposit.

16. Sign and date the form at the bottom and attach any required schedules and additional forms or supporting documents.

17. Mail the completed Form 1040A to the appropriate IRS address listed in the instructions or file electronically using an approved e-file provider.

What is the purpose of form 1040a?

The purpose of Form 1040A, also known as the "U.S. Individual Income Tax Return," is to report and calculate an individual's federal income tax liability for the tax year. This form is designed for taxpayers who have a more straightforward financial situation and do not qualify for certain tax credits or deductions. It allows individuals to report their income, claim various adjustments to income, claim tax credits, and calculate their tax liability or refund.

When is the deadline to file form 1040a in 2023?

The deadline to file Form 1040A for the tax year 2022 (which is typically filed in 2023) is April 17, 2023. However, please note that tax deadlines can sometimes change, so it's always best to double-check with the Internal Revenue Service (IRS) or a tax professional to ensure accuracy.

How can I send sba form 1010c for eSignature?

When you're ready to share your schedule m illinois instructions form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find illinois schedule m instructions?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific illinois schedule m for individuals and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the schedule m instructions in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your il 1040 schedule m form and you'll be done in minutes.