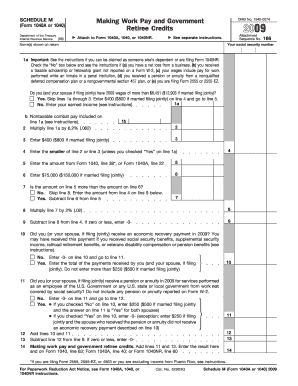

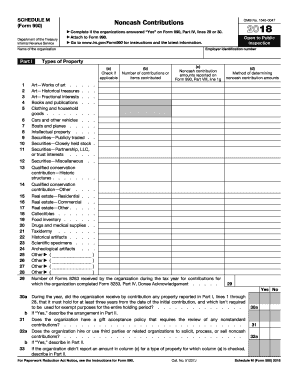

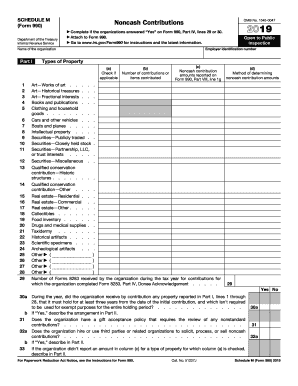

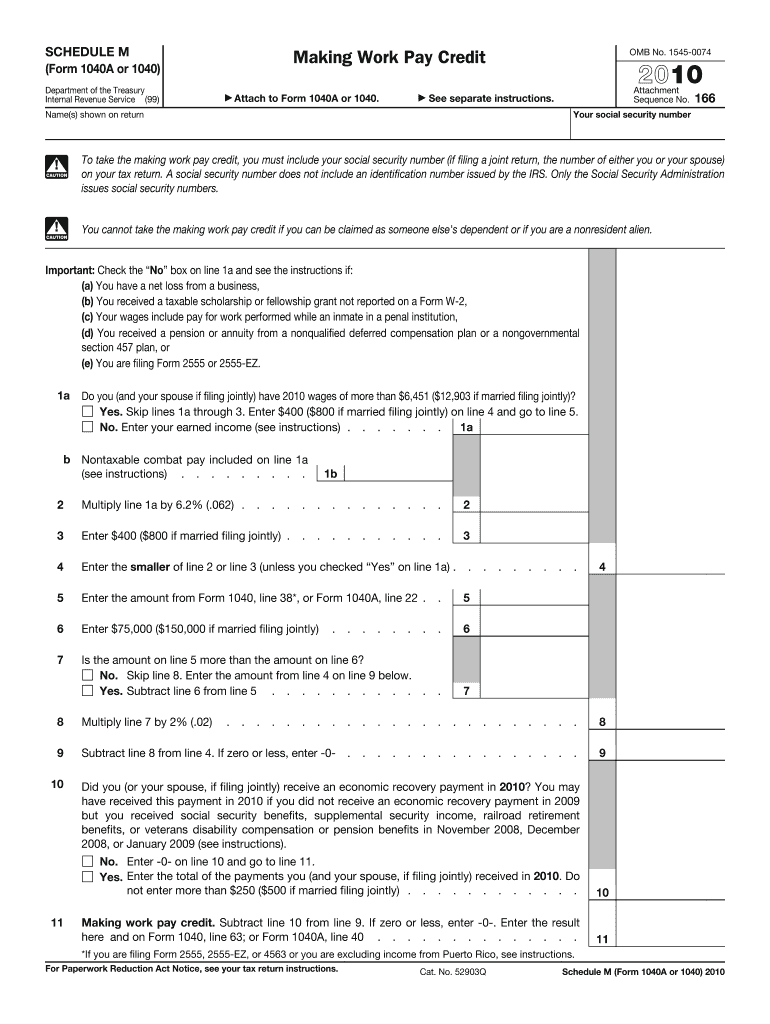

IRS 1040/1040A - Schedule M 2010-2026 free printable template

Instructions and Help about IRS 10401040A - Schedule M

How to edit IRS 10401040A - Schedule M

How to fill out IRS 10401040A - Schedule M

Latest updates to IRS 10401040A - Schedule M

All You Need to Know About IRS 10401040A - Schedule M

What is IRS 10401040A - Schedule M?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 10401040A - Schedule M

How can I correct mistakes on the IRS 10401040A - Schedule M?

To correct mistakes on the IRS 10401040A - Schedule M, you should file an amended return using Form 1040-X. Ensure you reference the specific errors on Schedule M and provide accurate information in your amended submission to avoid further issues.

What should I do if my IRS 10401040A - Schedule M is rejected when e-filing?

If your IRS 10401040A - Schedule M is rejected during e-filing, review the rejection codes provided by the e-file system. Address the specified issues, make the necessary corrections, and re-submit your form to ensure successful processing.

How can I ensure the security of my personal data when filing IRS 10401040A - Schedule M?

To maintain the privacy and security of your personal data when filing IRS 10401040A - Schedule M, use secure internet connections, employ reputable tax software that offers data encryption, and avoid sharing sensitive information through untrusted channels.

Can nonresidents file IRS 10401040A - Schedule M on behalf of others?

Yes, nonresidents can file the IRS 10401040A - Schedule M on behalf of others if they are designated as authorized representatives. It is essential to attach a valid power of attorney form to authorize this representation.

What are some common errors to avoid when submitting IRS 10401040A - Schedule M?

Common errors when submitting IRS 10401040A - Schedule M include incorrect Social Security numbers, failing to sign the form, and not including necessary documentation. Double-checking all inputs can help reduce the likelihood of these mistakes.